On January 26, Jucan Optoelectronics and Compass launched the 2023 annual report, which opened the curtain of A-share 2023 annual report disclosure. Entering the annual report disclosure season, the "report cards" of A-share listed companies in 2023 are emerging one after another.

Up to now, 2893 listed companies in the A-share market have first released the annual performance forecast for 2023.

According to the disclosed performance forecast data, some people are happy and others are worried. In 2023, both companies will change from decline to profit, and some companies will turn from profit to loss. On the whole, most of the companies have delivered satisfactory results.

two thousand eight hundred and ninety-three Forecasts of listed companies two thousand and twenty-three Annual performance

According to the iFinD data of Flush, as of March 6, 2893 of the more than 5000 A-share listed companies had first released the 2023 performance forecast.

Taking the average value of the upper and lower limit of revenue in the performance forecast as the statistical standard (the same below), four of the listed companies that have disclosed the performance forecast in 2023 are expected to have revenue of more than 100 billion yuan, ranking by revenue as Greenland Holdings, Gree Appliance, TCL Technology and Guizhou Moutai, respectively achieving revenue of 360 billion yuan, 207.5 billion yuan, 175.45 billion yuan and 149.5 billion yuan.

There are 44 companies whose revenue is expected to be 10 billion yuan or more in 2023, of which 7 companies, including Tianyin Holding, Huaqin Technology, Sungrow Power Supply, Transonic Holding, Huanxu Electronics, Junsheng Electronics and Hisense Video, are expected to have revenue of more than 50 billion yuan in 2023.

In terms of profitability, according to the 2023 performance forecast of listed companies, 1794 companies are expected to achieve profitability in 2023, accounting for more than 60%.

Among them, 10 companies expect that the annual net profit in 2023 (sorted by the average of the upper and lower limit of the expected net profit, the same below) will exceed the threshold of 10 billion yuan. It is estimated that the annual net profit of Moutai, a leading liquor producer in Guizhou, will reach 73.5 billion yuan in 2023, ranking first; China Shenhua takes the second place, with an estimated annual net profit of 59.3 billion yuan; Ningde Times is expected to have a net profit of 44 billion yuan, ranking third temporarily; The fourth and fifth place are BYD and Gree Electric, with the estimated annual net profits of 30 billion yuan and 28.15 billion yuan respectively.

From the perspective of changes in net profit, of the 2893 A-share listed companies that have disclosed their performance forecasts for 2023, 709 are expected to increase, 381 to turn losses, 440 to slightly increase, and 23 to continue to gain. A total of 1553 companies are expected to gain, accounting for 53.68%.

Among the companies with promising performance, according to the median expected net profit growth (the same below), 660 companies expect to double their net profit in 2023, 32 companies expect to increase their net profit by 10 times (1000%) in 2023, and 2 companies expect to increase their net profit by 50 times (5000%) in 2023; There are 429 companies whose net profit increases between 50% and 100%.

For individual shares, Lijiang shares topped the growth list with an expected net profit growth of 6074.35%, temporarily becoming the "pre increase king" of A-share market. As for the reasons for the performance growth, Lijiang shares said that since 2023, the tourism market has experienced a rapid recovery. The company seized the opportunity to actively carry out various marketing activities, and the tourist reception has significantly rebounded; Huicheng Environmental Protection ranked second with an expected net profit increase of 5802.33%. The company said that the main reason for the change of net profit in 2023 was the completion and operation of new projects.

Huadian International estimates that the annual net profit in 2023 will increase by 4465% year on year, ranking the third temporarily. As for the reasons for the expected increase of business performance in 2023, the company said that it was mainly due to the comprehensive impact of the decline in fuel prices, the incremental benefits contributed by new projects and the reduced investment income of coal enterprises.

More than 60% of companies on the main board and GEM are expected to make profits

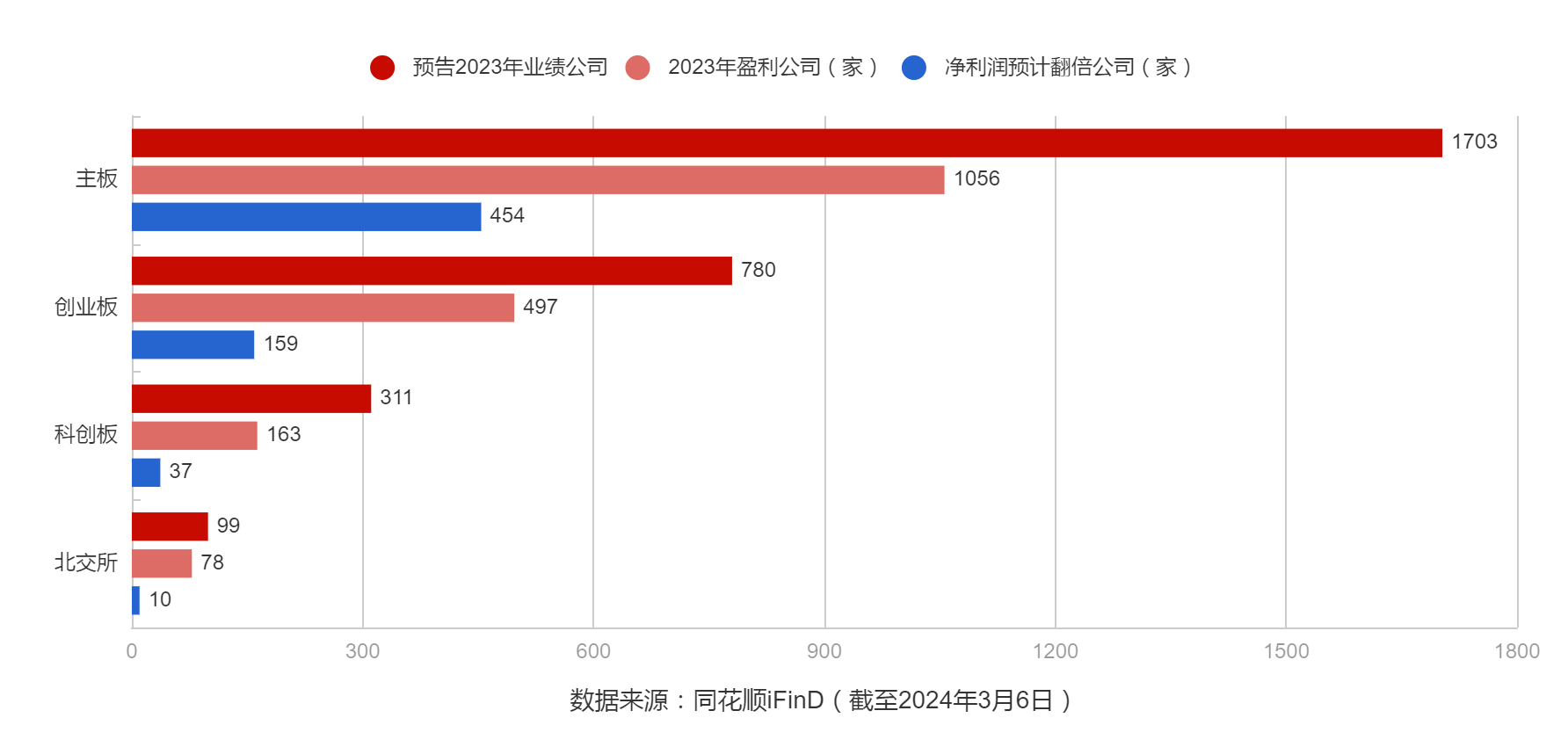

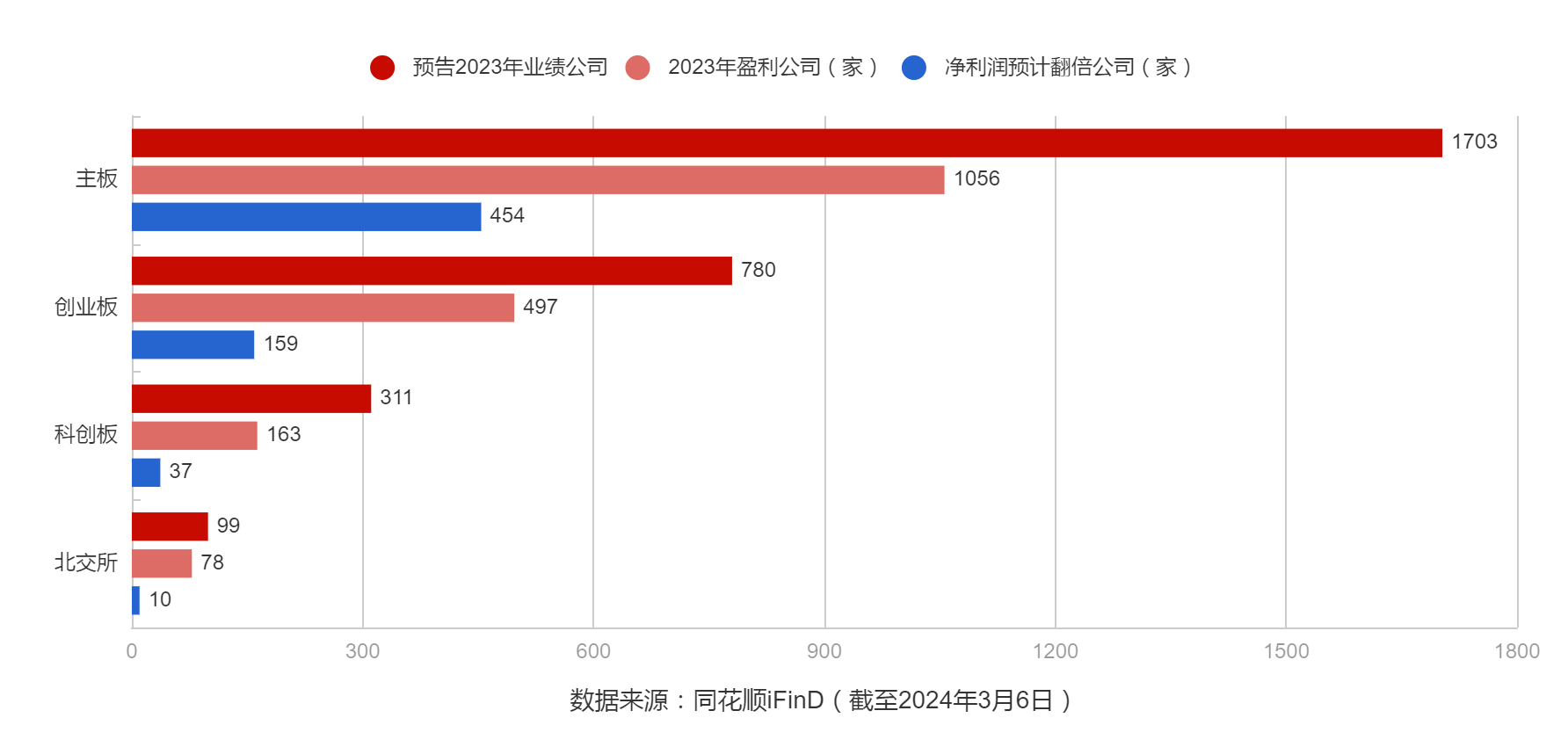

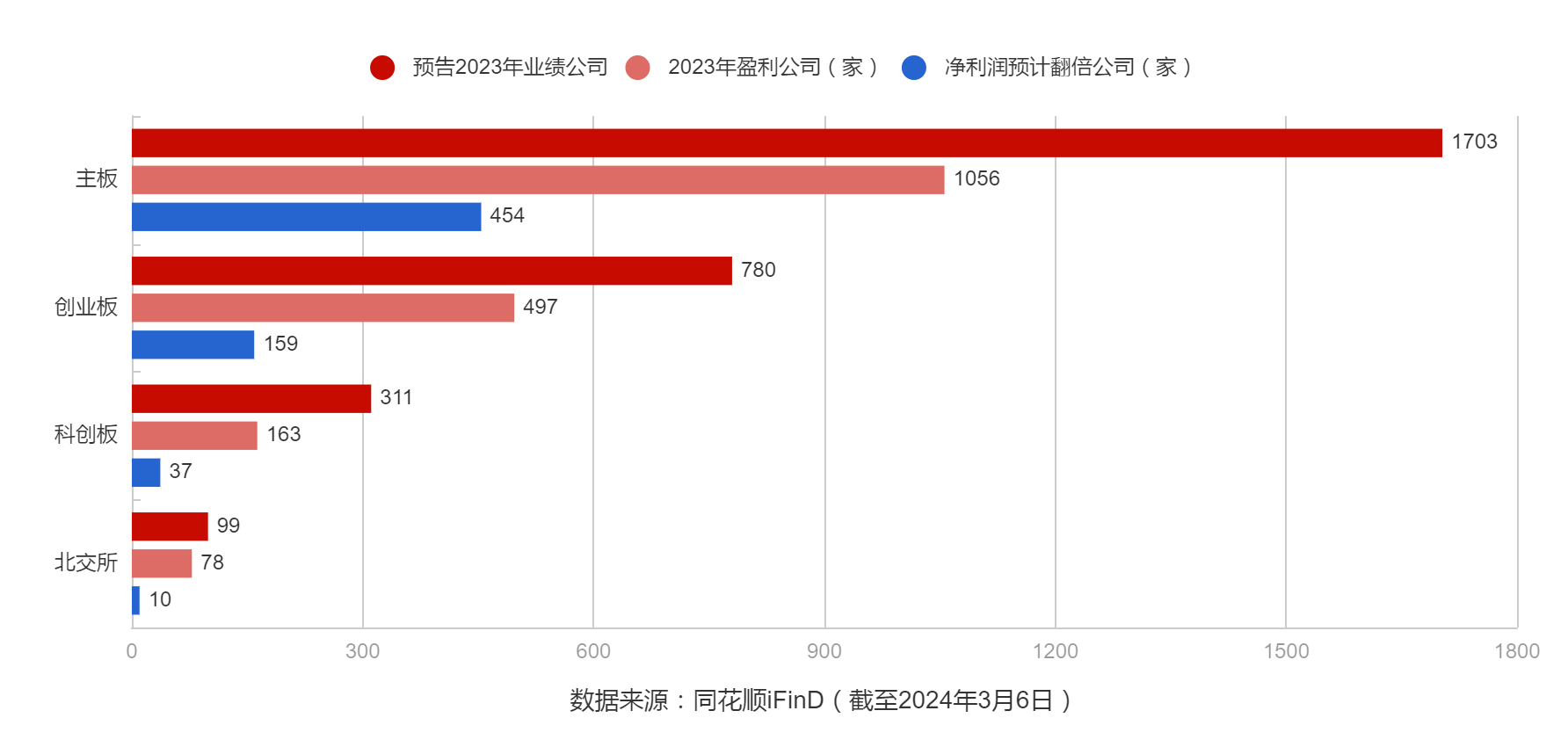

From the disclosure of 2023 performance forecasts on each listed board, the number of main board companies is the largest, including 900 in Shenzhen and 803 in Shanghai; There are 780 GEM and 311 science and technology innovation boards respectively; A total of 99 listed companies in Beijing Stock Exchange issued performance forecasts for 2023.

In terms of performance, the main board listed companies lead other sectors in terms of revenue scale, net profit, or net profit growth.

According to the iFinD data of Flush, four companies whose revenue is expected to exceed 100 billion yuan in 2023, namely Greenland Holdings, Gree Appliance, TCL Technology and Guizhou Moutai, and nine companies whose net profits are expected to exceed 10 billion yuan, including China Shenhua, BYD and Zijin Mining, are all listed on the main board.

Of the 1703 main board listed companies that have released their 2023 performance forecasts, 1056 will be profitable in 2023, accounting for 62.01%. In 2023, there will be 989 companies listed on the main board, accounting for 63.68%.

From the perspective of net profit growth, 454 companies on the main board are expected to double their net profits in 2023, of which 20 companies are expected to increase their net profits by more than 10 times.

Among GEM companies, there are only 4 companies whose revenue is expected to reach 10 billion in 2023, namely Sungrow Power, Huichuan Technology, Kanglong Chemical and Jiangbolong. It is expected that the revenue will reach 73.5 billion yuan, 30.026 billion yuan, 11.55 billion yuan and 10.25 billion yuan respectively in 2023.

In terms of profitability, 497 companies on the GEM are expected to be profitable in 2023, accounting for 63.72%. There is only one company with a net profit of more than 10 billion yuan, which is Ningde Times. It is estimated that the annual net profit in 2023 will be 44 billion yuan; 159 companies are expected to double their net profits in 2023, of which 11 companies will increase their net profits by more than 10 times.

Among the companies that have disclosed the performance forecast for 2023 on the Science and Technology Innovation Board, only Transvoice Holdings and Zhuhai Guanyu are expected to have a revenue of more than 10 billion yuan in 2023, and two companies are expected to have a revenue of 62.122 billion yuan and 11.45 billion yuan in 2023; In terms of net profit, Jinko Energy is expected to have a net profit of about 7.6 billion yuan in 2023, ranking first temporarily. In addition, 37 companies are expected to double their net profits in 2023, of which only one company, China Science and Technology Avionics, has a net profit increase of more than 10 times.

In contrast, among the companies that have disclosed the performance forecast in 2023 by the Beijing Stock Exchange, Yun Xingyu's estimated revenue ranks first temporarily, and the company's estimated revenue in 2023 is about 2.312 billion yuan; In terms of profitability, 14 companies are expected to have a net profit of over 100 million yuan in 2023, of which Liancheng Numerical Control is expected to have a net profit of about 705 million yuan in 2023, ranking first temporarily.

In terms of net profit growth, 10 companies of Beijing Stock Exchange, such as Digital Human, Hanxin Technology, Hengtuo Kaiyuan, are expected to double their net profits in 2023.

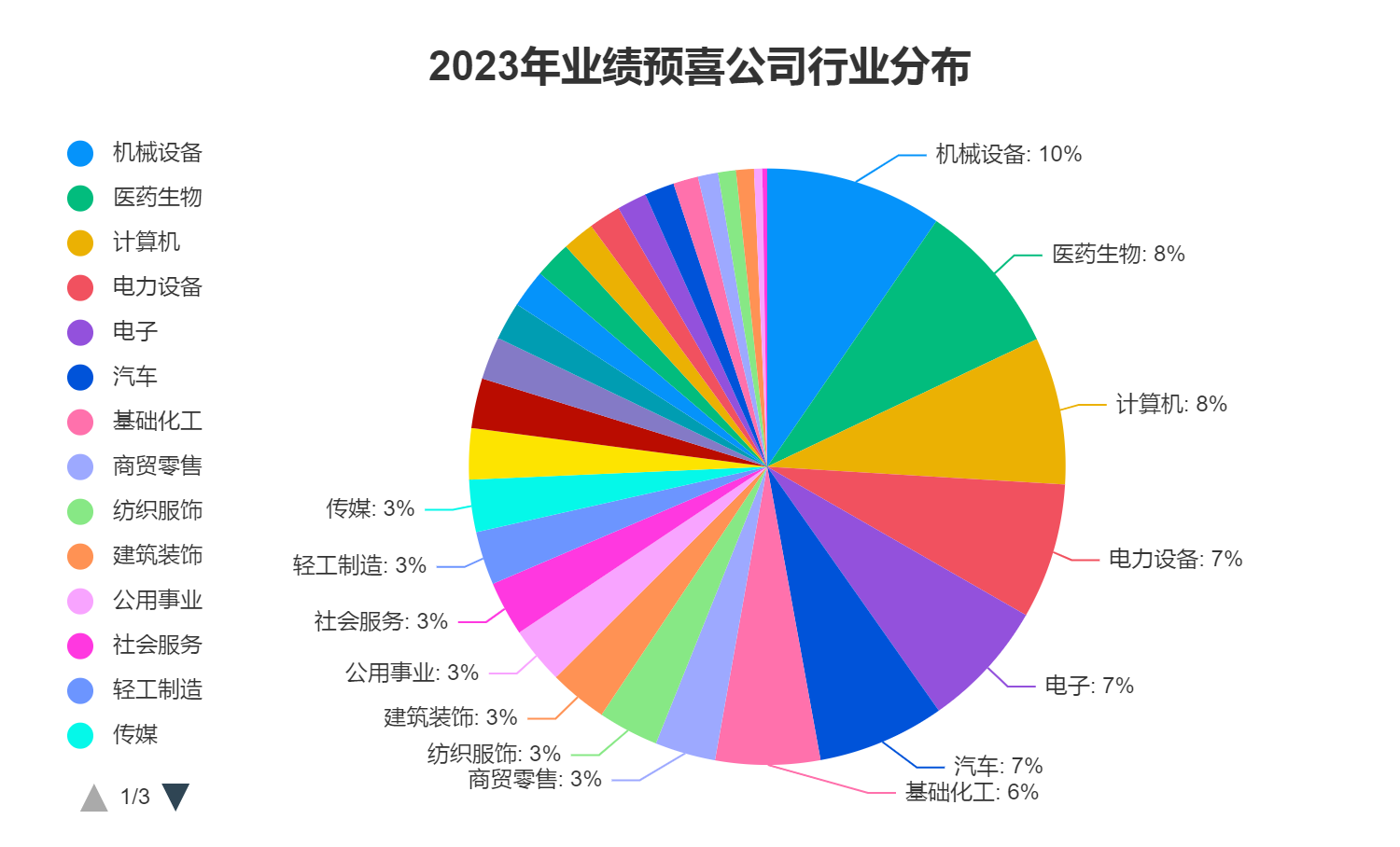

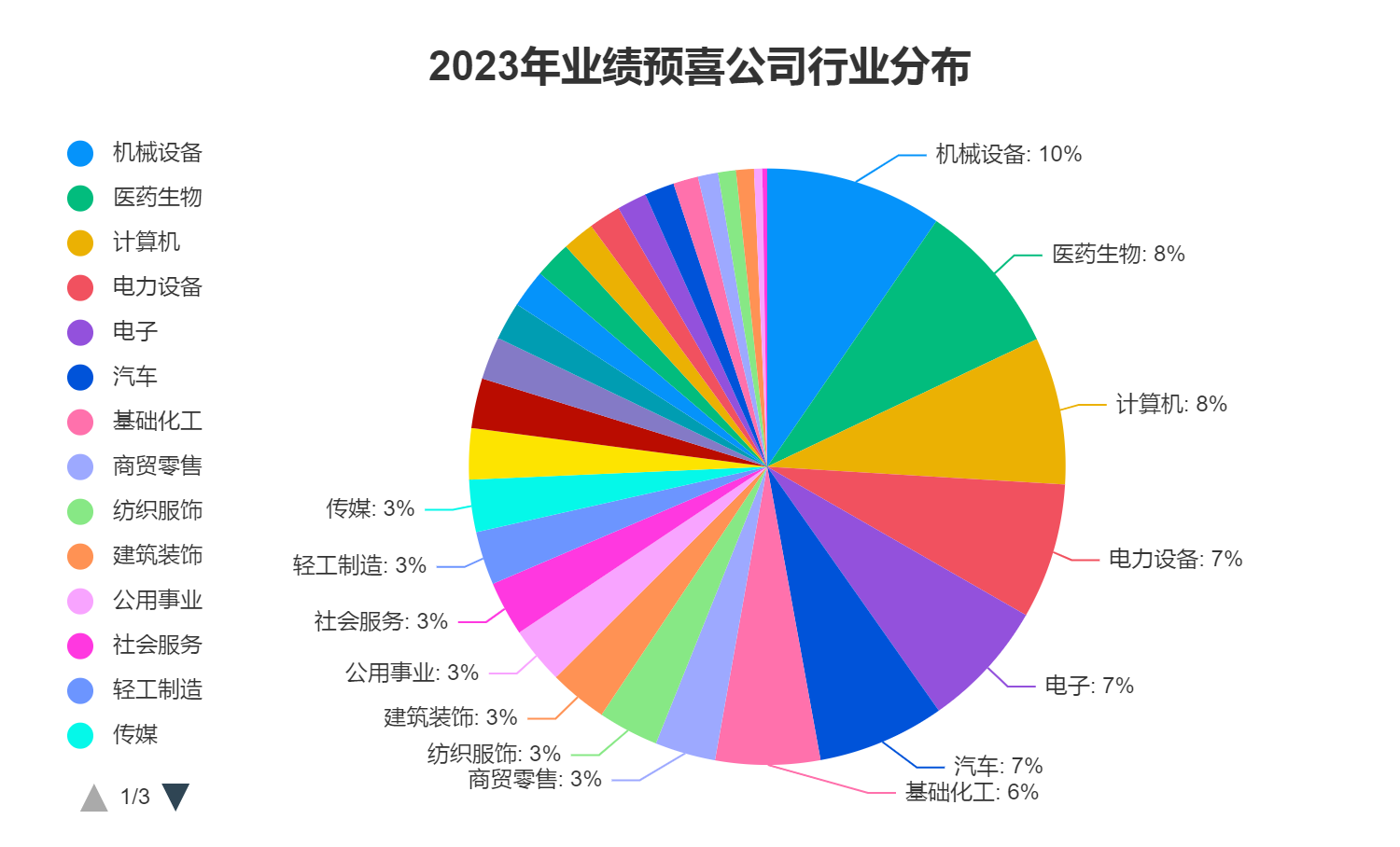

Performance of machinery equipment, medicine and biology industry is expected to be gathered by companies

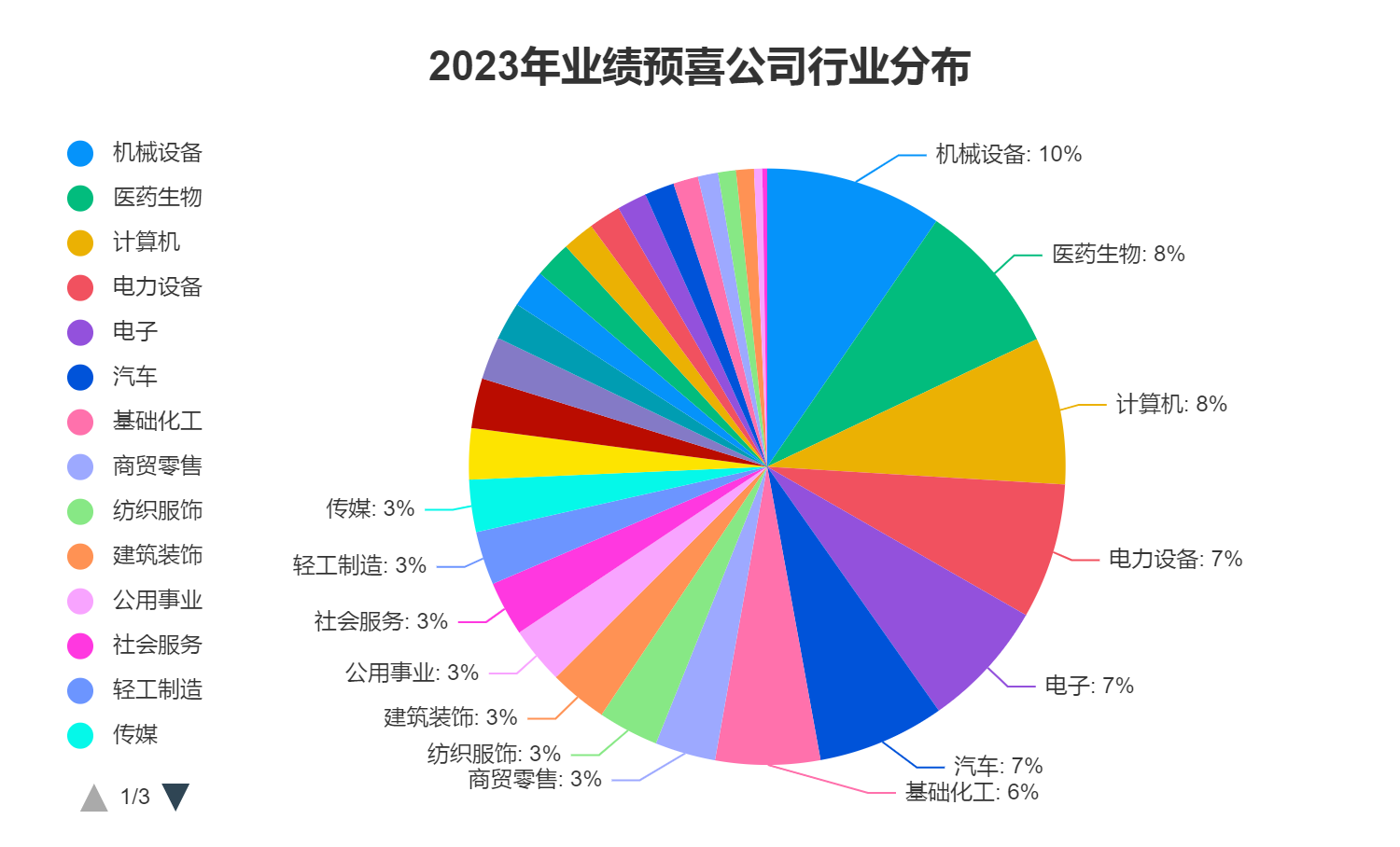

Judging from the disclosure of performance forecasts of listed companies in various industries, according to the iFinD data of Flush, according to the Shenyi level industry classification, there are more companies in the electronics, mechanical equipment, medicine and biology, basic chemical industry, computer, electric power equipment and automobile industries that will disclose their performance in 2023, respectively 277, 268, 245, 239, 232, 204 and 155, totaling 1620.

In terms of performance, the seven major industries of machinery and equipment, medicine and biology, computer, power equipment, electronics, automobile and basic chemical industry are also the "cluster" industries of companies with good performance.

Data source: Flush iFinD (as of March 6, 2024)

According to the statistics of iFinD in Flush, there are 149 companies in the mechanical equipment industry who are expected to have good performance in 2023, which is the industry with the largest number of companies. For individual shares, Huichuan Technology ranked first with an estimated revenue of 30.026 billion yuan and an estimated net profit of 4.773 billion yuan.

The performance of the mechanical equipment industry is expected to increase by Wang Weilongxi. The company expects that the annual net profit in 2023 will be about 175 million yuan, an increase of 3019.53% compared with -5.99 million yuan in the same period of the previous year, turning losses into profits. The net profit of Yawei shares is also expected to increase by more than 10 times. The company expects that the net profit in 2023 will be about 109 million yuan, with a year-on-year growth of about 3019.53%. In general, 56 enterprises are expected to double their net profits.

A total of 130 companies in the pharmaceutical and biological industry are expected to have good performance. Kanglong Huacheng is expected to achieve revenue of about 11.55 billion yuan in 2023, temporarily ranking first in revenue; China Resources Sanjiu expects a net profit of about 2.942 billion yuan in 2023, leading other pharmaceutical and biological companies.

The pharmaceutical and biological industry is expected to double its net profit by 50 enterprises in 2023. The expected increase in performance is Sunflower. The company expects that the annual net profit in 2023 will be about 23 million yuan, with a year-on-year growth of about 2119.85%. Next is Preh Ophthalmology. The company expects a net profit of 273 million yuan in 2023, with a year-on-year growth of 1224.75%.

There are 124, 114, 108, 107 and 88 enterprises in the computer, power equipment, electronics, automotive and basic chemical industries, respectively. It is estimated that 53, 45, 39, 49 and 37 enterprises will double their net profits in 2023.

Among computer companies, two companies, New Guodu and Chen'an Technology, are expected to increase their net profits by more than 10 times in 2023, 1574.85% and 1079.9% respectively; There is only one enterprise in the power equipment industry, the electronics industry and the basic chemical industry whose net profit is expected to increase by more than 10 times in 2023, which are respectively Dike, Zhongke Flight Testing and Dawei.

In the automotive industry, the net profits of four companies, namely Weifu High Tech, Foton Motor, Huapei Power and General Motors, are expected to increase by more than 10 times in 2023, respectively 1518%, 1436.15%, 1298% and 1285.5%. As for the expected increase of performance, Weifu High Tech, Foton Motor and General Motors mentioned the impact of "overseas export growth" in their performance forecasts.

It is worth noting that although the electronics and basic chemical industries are expected to lead in the number of enterprises, they are also the industries where the expected net profit decline in 2023 is concentrated. According to the iFinD data of Flush, 169 enterprises and 151 enterprises in the electronics and basic chemical industry are expected to decline in net profits in 2023.

Among electronic companies, Yutaiwei's net profit attributable to the parent company will be - 150 million yuan in 2023 and - 408500 yuan in 2022, further expanding the scale of losses; In 2023, Core Sea Technology will also turn from profit to loss, with a net profit attributable to the parent company of - 143 million yuan. The losses of both companies in 2023 are due to the decline in the prosperity and demand of consumer electronics and other end markets.

Among basic chemical companies, 49 companies such as Asia Pacific Industry, Oak, Black Cat, Yangmei Chemical and Quanwei Technology are expected to turn from profit to loss in 2023.

Annual report predicted that the stock price rose in the past month, with an average increase 6.69%

With the advent of the annual report season, the performance of listed companies has attracted the attention of the market, and the performance of individual stocks beyond expectations is often a catalyst for the rise of stock prices.

Wind data shows that, as of the close of March 6, 1038 stocks of the performance forecast stocks in 2023 have risen in the past month, and 505 stocks have fallen, with an average increase of 6.69%. In terms of individual shares, Kelai Electromechanical has the largest increase in the past month, with a range increase of 258%. The company expects to achieve a net profit attributable to the parent company of 91.4799 million yuan to 97.9221 million yuan in 2023, a year-on-year increase of 42% to 52%; Lobotec and High tech Development rose 142.99% and 137.71% respectively, closely followed.

In the past month, among the stocks whose net profit is expected to double in 2023, 428 stocks rose and 226 stocks fell, with an average increase of 5.57%.

Among the stocks whose net profit is expected to decline in 2023, 799 will rise and 539 will fall, with an average increase of 4.1%.

In terms of individual stocks, the biggest increase in the past month is Thermo Smart, with a range increase of 70.27%. The company expects a net loss of 30 million yuan to 45 million yuan in 2023, and a profit of 21.2046 million yuan in 2022; The non ST company with the largest decline is Baili Technology, whose share price has dropped 29.92% in the past month. The company expects to lose 88 million yuan to 128 million yuan in 2023, and make a profit of 8.5885 million yuan in 2022.

Standing at a new starting point in 2024, many institutions believe that A-share earnings are expected to recover in 2024.

CICC forecasts that profit growth of A-share listed companies in 2024 is expected to improve marginally. According to the top-down estimation, in 2024, the profit of all A/non-financial listed companies will increase by 4.7%/5.1% year on year, which is better than that in 2023.

"As for A-share, the bottom of its profit has appeared, and with the economic recovery in 2024, the profit advantage of high-quality leading assets is expected to appear." Industrial Securities believes that the bottom of this round of A-share profit will be basically confirmed in the second quarter of 2023, and the growth rate of all A and all A non-financial cumulative net profit attributable to the parent in the third quarter of 2023 will rise 2.3% and 5.3% respectively from the second quarter of 2023, In 2024, corporate profits are expected to continue to rise, driving the market and high-quality assets to stabilize.

Huafu Securities Research Newspaper pointed out that in the medium and long term, the domestic economy will continue to recover. The fundamentals of listed companies have emerged in the second quarter of last year, and this year's earnings are expected to continue to improve. On the overseas side, the Federal Reserve may start the interest rate cutting cycle this year, the global liquidity margin will improve, and the long-term rise in the A-share market has not ended.