"According to the statistics of reporters of the Huaxia Times two month seventeen Japan, China has twenty-three Provinces announced two thousand and seventeen The annual fixed asset investment target, the cumulative investment of the sum of the figures exceeds forty Trillion yuan, plus the provinces that have not yet been announced, the investment this year will be no less than forty-five Trillion. "

On the weekend, I felt that the whole person was not good when I saw the news.

What is the concept of 45 trillion yuan? At the end of 2015, China's total population was 1.375 billion, which is equivalent to the requirement that every Chinese, regardless of men, women, old and young, should invest 33000 yuan; The world has a population of 7 billion, which is equivalent to 6400 yuan invested by each person in the world

What project can sustain such a large investment?

Of course, there are countless "railway, highway, airport, subway and other" railway, highway and airport "projects. We have been doing this for more than 10 years, haven't we? The explosive hidden danger of the "4 trillion" investment in 2008 that caused China's debt soaring and housing prices soaring has been still there. Is it possible to simply add 40 trillion in 2017 to commemorate that 4 trillion?

As ordinary people, we can't understand the grand strategy of the country. The only question we want to ask is: is RMB money or not?

If it was money, China's total reserve currency in January 2017 was only 30.8 trillion yuan, the total balance sheet size of the central bank was only 34.8 trillion yuan, and China's total broad money supply M2 at the end of 2016 was only 155 trillion yuan, which suddenly generated 45 trillion yuan of investment. How many new loans need to be issued and how many new RMB needs to be printed to keep up?

From a worldwide perspective, it is even more amazing. 45 trillion yuan, equivalent to about 6.5 trillion US dollars, I do not know whether the total investment of other countries in the world in 2016 is large?

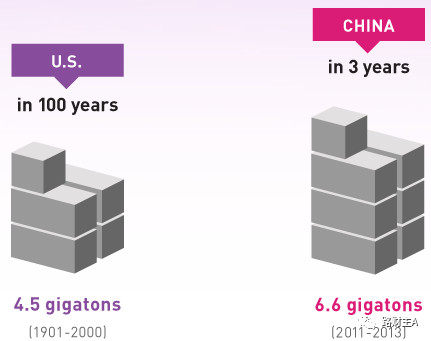

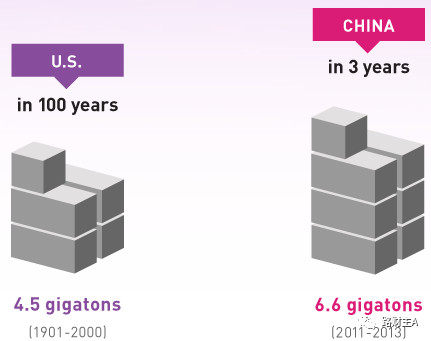

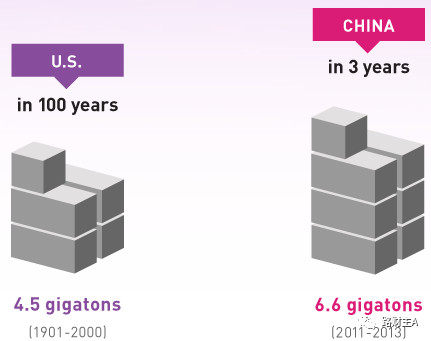

Bill Gates, the richest man in the world, published a data on his blog in 2014. From 2011 to 2013, China consumed 6.6 billion tons of cement, nearly 1.5 times the cement consumption of the United States in the whole 20th century!

What is cement? It is the foundation for the construction of railway, highway and machinery infrastructure projects. As we all know, the United States was in the heyday of expansion throughout the 20th century. Most roads, bridges and skyscrapers were built at that time. The land area of China and the United States is about the same. Three years is worth more than 100 years. This figure is enough.

So, is the 45 trillion yuan investment in 2017 the rhythm of preparing the earth to explode?

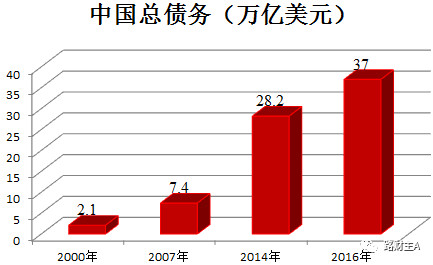

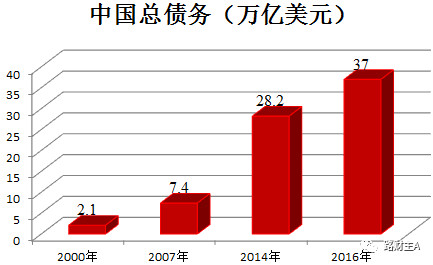

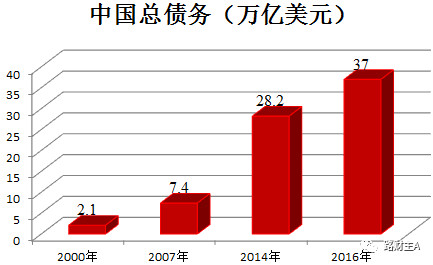

I have written several articles to discuss China's debt. It is precisely after the 4 trillion investment in 2008 that China's overall debt has increased rapidly - China's total debt in 2007 was only 7.4 trillion yuan, and by 2014 it had rapidly increased to 28.2 trillion dollars. According to the debt data at the end of 2016, it has reached 37 trillion dollars according to the latest exchange rate

You know, as the global currency, the total debt of the U.S. government is only 21 trillion dollars. When our GDP is less than 60% of the U.S., the total debt has reached 37 trillion dollars at the exchange rate. I don't know what to say

The debt of US $37 trillion is either not worth so much, or China is out of the gravity

If we launch 45 trillion yuan of investment on this basis, is our debt ready to double? If doubled, the global GDP at the end of 2015 will still be less than 74 trillion dollars, and China's total debt will exceed the world's GDP by then!

According to traditional experience, the majority of government led infrastructure projects in China have less than 1/5 of their own funds, and most of the rest come from bank credit. If the investment of 45 trillion yuan comes true, it is definitely an expected result that the data of RMB basic currency and broad money supply will double in a few years (after 4 trillion yuan in 2008, the broad money supply will quickly change from 47 trillion yuan at the end of 2008 to 97 trillion yuan at the end of 2012), and the future of the people's currency is bound to be money shortage

According to the 21st Century Economic Report, compared with the beginning of 2016, the prices of most consumer goods in 2017 are rising rapidly. It is especially hard to believe that the prices of electronic consumer goods, such as mobile phones, computers, and tears of air conditioners, which have been falling in the past decade, are rising, not to mention the rise of bulk commodities in the past 2016

Even though China is indeed in a debt deflation cycle, in order to avoid a debt crisis and a credit crisis, it needs to release a certain amount of credit, but the data of 45 trillion yuan is really shocking. It is obviously going to destroy the earth and the currency!

It seems that no matter India, Russia, Brazil or China, all the governments of emerging countries have a rock solid belief in their minds: printing money, making the world a better place!

I don't know what people in the future will think of today's world and China. Maybe they will also sigh about Chinese investment and money printing as in the Yuan Opera: printing, people suffer, stop, people suffer.